|

|

|

|

|

|

Happy New Year! As we begin 2022, we look at the challenges, opportunities and themes that will impact education in the year ahead, we explore the post-secondary education landscape, and highlight the key trends of 2021. Each month, we will share a snapshot of key trends, showcase the stars of today and tomorrow, offer our insight on mergers, acquisitions and fundraising, as well as providing some further food for thought.

|

|

|

|

|

2022: Third Time’s the Charm?

Tony Wan, Reach Capital

Happy New Year!

For the past two years, that greeting hasn’t always delivered as the pandemic waxed, waned and returned, upending livelihoods and testing our resilience.

In 2022, will the third time be the charm?

This month, as the new coronavirus variant surges and schools close again, it all feels a little déjà vu. The pandemic delivered a blow to an already vulnerable public education system and magnified systemic challenges. Large school districts in New York, Los Angeles, San Francisco and Chicago have collectively lost more than a quarter-million students, representing the largest declines ever. Since funding is dependent on enrollment, their budgets have shrunk as well.

Colleges are also reeling. Undergraduate enrollment dropped 3.2 percent in fall 2021, after dipping 3.4 percent the previous year. Particularly troubling are male students whose enrollment decline was seven times that of their female peers.

Not surprisingly, The Great Resignation has also impacted education, which has suffered from low pay and poor working conditions for too long. Teacher shortages abound as educators leave the system and seek out alternatives on technology-driven learning platforms.

The pandemic is also fueling a mental health crisis across all ages. The U.S. Surgeon General and three pediatric health associations have declared a national emergency given alarming increases of youth depression, anxiety, emergency-room visits and suicide. Employers say workers are increasingly leaving for mental health reasons.

These vulnerabilities come at a time when alternatives to traditional education have exploded. Virtual and hybrid schools, homeschools and charters that are designed to be more nimble and responsive will continue to draw teachers, students and parents away from the system.

Technology will never fully replicate the visceral joys of in-person learning. But it can—and has—extended the village of support that students, parents and educators need. An improved infrastructure has allowed districts to tap remote professionals to provide 24/7 tutoring, reading support, therapy, counseling and other services. It lets colleges provide flexible learning options for nontraditional students and connect them with employers on meaningful projects where they apply what they learn to practice.

Accelerating technological developments will further empower people to pursue learning in ways that suit their lives. Already the creator economy lets anyone teach and earn on their own. The latest buzz is web3, the next evolution of the internet that promises to transform how we build, learn and interact online. Companies are creating opportunities to learn web3 while earning at the same time. Decentralized autonomous organizations (DAOs) have emerged around liberal arts education and crypto projects affiliated with major universities. There is a metaverse where teachers connect.

It can seem a stretch to see how tomorrow’s technologies are pertinent to our lives today. But in the words of a late economist: “things take longer to happen than you think they will, and then they happen faster than you thought they could.”

Bridging that gap depends largely on how quickly the current public system can adapt. That takes more than tech and capital. It needs strong leadership that can steer fundamental and radical changes to the education system. And it starts with recognizing the reality of a new life-work balance desired by teachers and students, and an appreciation of the tools that amplify human connections and potential.

Thank you to my colleagues Jennifer Carolan, Wayee Chu, Jomayra Herrera and Jennifer Wu for contributing to this piece.

|

|

|

|

|

Reshaping the post-secondary education landscape

As the name suggests, post-secondary education is what follows secondary education. Contrary to popular belief, post-secondary education’s definition is considerably wider than just university - it also includes public and private colleges, technical training institutes, vocational schools and, more recently, new breeds of credentials. Often seen as the ticket to a more prosperous future, there are approximately 220 million students in post-secondary education worldwide today, up from 100 million in 2000 (1).

While university – where students obtain a bachelor’s degree during three to four years of study – remains the most well-known and well-attended form of post-secondary education, its time commitment and high costs have created significant pain points for students. These pain points, combined with increasing digital transformation efforts have widened the post-secondary landscape and given birth to a plethora of alternative pathways for school leavers.

The rise of online programme managers (OPMs) is a key example of this. By partnering with universities to take their programmes online, OPMs have allowed colleges and universities to take their courses to wider markets, while at the same time alleviating those pain points experienced by students.

Another development is the emergence of ‘new credentials’ – shorter, more flexible certifications offered by a range of providers which are gaining credibility among learners, employers and governments. These new types of online credentials – various certificates, badges and MicroMasters– are playing a complementary role for newer, more affordable degree programs. Bootcamps are another popular form of new credential. They follow a short-term skills training model and offer hybrid, condensed educational courses.

Changing needs of students and employers alike have resulted in the growth of newer credentials and have seen post-secondary education pivot from focusing directly on traditional students aged 18 to 24 to also catering for the needs of adult learners. Greater cohorts of adult learners are looking to develop new skills and knowledge in order to advance their careers and remain competitive in a challenging employment market. At the same time, businesses are investing more in the upskilling of their employees, particularly in high demand industries where skills gaps exist. In essence, we are seeing the sector transitioning to offer students more flexible higher learning pathways and delivery models, filling the gaps left by traditional universities and courses.

(1) - https://www.worldbank.org/en/topic/tertiaryeducation#1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| M&A Activity > |

|

|

|

| Significant Fundraising Activity > |

|

|

|

|

|

2021 Market Analysis and Key Trends

Key Points

As we head into the third year of the COVID-19 pandemic, now is an appropriate time to reflect on the transformative impact the pandemic has had on EdTech and investment in the sector. Seen as a somewhat niche sector prior to the onset of the pandemic, EdTech’s people and technology have played a considerable role in powering students, teachers, businesses and governments in a world pushed online in the face of restrictions and regulations imposed over the last two years.

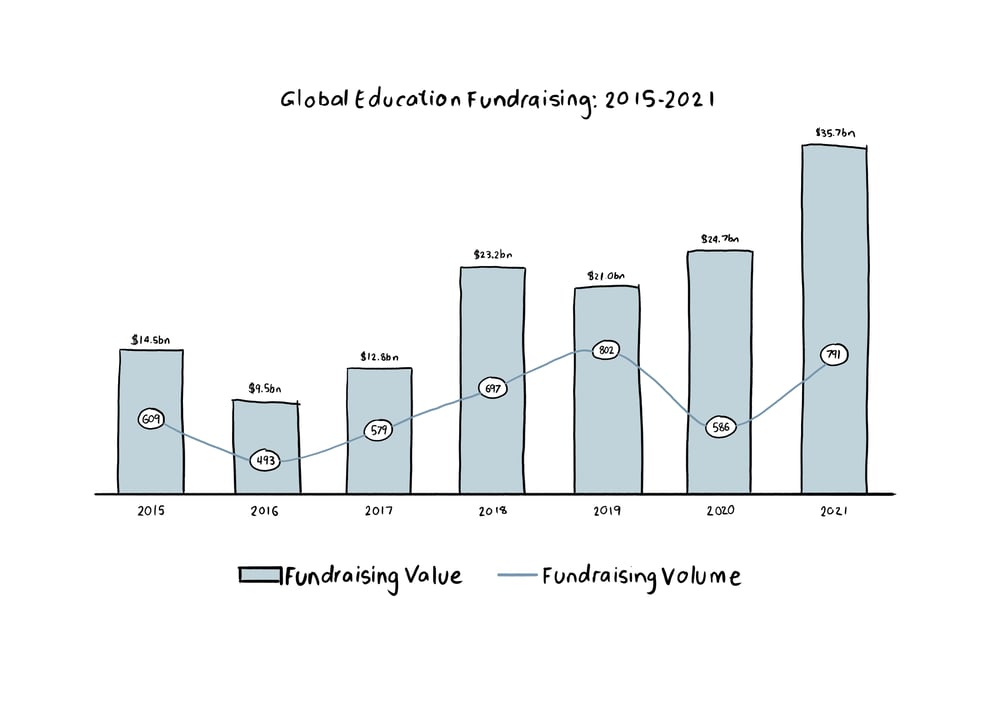

In return, strategic and financial buyers have invested heavily into the sector despite the lingering uncertainty surrounding COVID. Fundraising continued its upward trend, increasing by 45% to reach $35.7bn in 2021 with deal volumes also increasing a considerable 35% during 2021 compared to 2020. The single largest round in 2021 was Articulate’s $1.5bn Series A round which included participation from some of the world’s biggest investors in Blackstone and General Atlantic. The round valued the US-based Company - which develops e-learning software tools for designing courses, presentations, quizzes and surveys - at $3.75bn and conferred unicorn status upon the Company. Other EdTechs to gain unicorn status in 2021 include ApplyBoard ($3.2bn), Eruditus ($3.2bn) and GoStudent ($1.7bn). This year also saw a select few leave the unicorn list as they IPO’d and raised capital publicly for the first time – among them were Udemy (Oct-21), Duolingo (Jul-21) and Coursera (Mar-21).

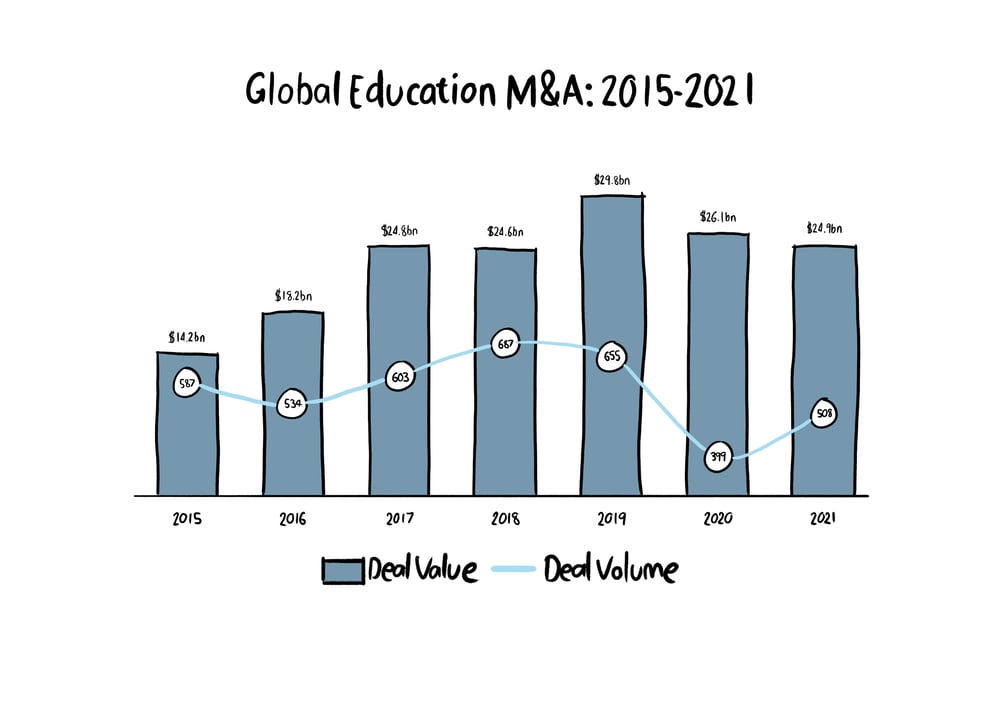

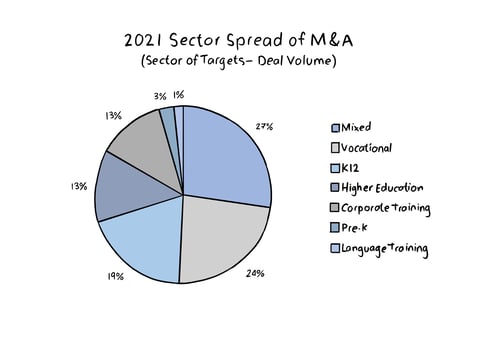

While M&A deal values declined slightly (down 5% to $24.9bn) in 2021 compared to 2020, deal volumes increased by an impressive 27% to 508. In global M&A, we saw Platinum Equity acquire education materials provider McGraw-Hill from Apollo in a deal which valued the business at more than $6bn. This deal alone accounted for close to 20% of global education M&A values this year. Another private equity acquisition was the second largest M&A deal this year. In a take-private transaction, Clearlake Capital acquired learning and development solutions provider Cornerstone OnDemand in a deal worth close to $5bn. Together with Platinum Equity’s acquisition of McGraw-Hill, these two deals accounted for approximately a third of global education M&A values in 2021 and clearly evidence private equity’s interest in the sector.

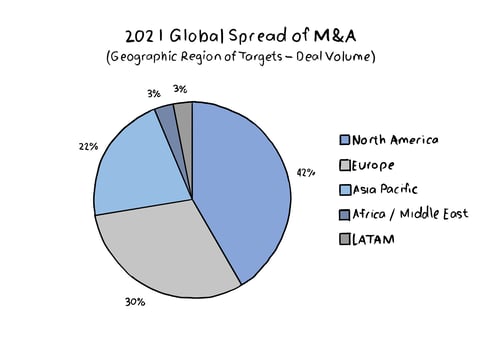

A 2021 EdTech wrap-up would not be complete without discussing China. Previously a clear EdTech investment leader, the Chinese government’s imposition of policies which restricted the ability of Chinese companies teaching academic curriculum to earn profit, pursue IPOs or take foreign investment materially impacted the EdTech investment landscape in the country. According to HolonIQ, the restrictions were the main contributing factor to an $8bn collapse in venture funding in the country in 2021, with India overtaking China as the venture funding leader in Asia. North America continued to lead the way in volume of M&A deals, accounting for 42% of M&A deals in 2021, with Europe following at 30%. The Chinese government’s regulations were also behind the Asia-Pacific region falling to third in line, contributing 22% in 2021 which is down from 28% a year prior.

Looking forward, there are a number of key trends which are expected to define 2022. Among these are AI-enabled adaptive learning which harnesses artificial intelligence to create more personalised and interactive learning experiences with the aim of driving higher levels of engagement and achievement. Gamification is another key trend. Similar to AI-enabled adaptive learning, the goal of gamification is to keep students engaged throughout their learning experiences. Gamification can be particularly powerful in online programmes which lack personal interaction. A final key trend expected to be prevalent in coming years is the use of virtual reality and augmented reality, which has the ability to create immersive learning experiences for students.

A key lesson from the pandemic and the last two years is our desire and need for flexibility and adaptability. The innovations developed by the EdTech segment played a crucial role in meeting these desires and needs during a challenging time for students, teachers, businesses and governments worldwide. The accelerated adoption of these technologies considered alongside a new wave of innovation and clear investor appetite in the sector all point towards another year of growth for EdTech.

|

|

|

|

|

|

|

|

|

|