|

|

|

|

|

|

In this month's X Report, experts at UNICEF explore a once-in-a-generation opportunity to reimagine education, we share news on the 2022 EdTechX All Stars Awards, and look at the pandemic's impact on education valuations. Each month we will share a snapshot of key trends, showcase the stars of today and tomorrow, offer our insight on mergers, acquisitions and fundraising, as well as providing some further food for thought.

|

|

|

|

|

From a stumbling block to a building block: Catalizing a once-in-a-generation opportunity to reimagine education

Robert Jenkins, Director of Education and Adolescent Development, Auken Tungatarova, Juan-Pablo Giraldo, Rachel Cooper, and Frank Van Cappelle. UNICEF.

Even before COVID-19, we faced the mounting challenge of a global learning crisis. 260 million children were not in school. Those who were, were learning very little, with 53% of 10 year olds in low- and middle-income countries unable to read and understand a simple text. Now, after two years of disruptions to schooling, that may increase to 70%. Nearly 1.6 billion children were affected by school closures, costing this generation around $17 trillion in lifetime earnings. What’s more, an estimated 24 million children are at risk of never returning to school, and girls face heightened risks, such as early marriage and pregnancy.

Tackling a growing learning crisis on top of a global pandemic has been an uphill battle, yet the global community has seized opportunities for innovation in education, and public-private partnerships have enabled strengthened infrastructure and uptake of multi-modal approaches and technologies – including mobile, radio, TV and printed kits to reach the most marginalized, as well as high-tech digital solutions and online platforms.

However, for many – especially the most marginalized children – remote learning opportunities are still limited or inaccessible, with two thirds of the world’s school-age children having no Internet connection at home. At least 463 million children were not reached by digital and broadcast programmes at all, especially those living in rural areas and/or poor households. The devastating reality is that the actual number may be even higher.

This is why, with a commitment to children and their futures, UNICEF set an ambitious goal to reach 3.5 billion children and young people by 2030 with world-class digital learning solutions through its Reimagine Education Initiative. To achieve this, acceleration in infrastructure development, access to devices for learners, and affordable connectivity are needed, in tandem with capacity building and a paradigm shift in the role of teachers and technology in and outside of the classroom. This builds on the projected growth of the online education market, estimated to reach $350 billion by 2025.

UNICEF has been engaging in partnerships for impact through flagship initiatives such as the Learning Passport, developed together with Microsoft and listed in the TIME’s 100 Best Inventions of 2021. This platform has supported learning for more than 2 million users in 20 countries (and counting) through its flexible online, mobile and offline features. Another example of a successful partnership has been Akelius Language Learning, providing digital learning opportunities for refugees and migrants in nine countries. And there are many more examples of such partnerships and solutions.

Technologies can already offer so much, such as engaging interactive content and boundless opportunities for learning, collaboration, communication, creativity, and innovation. Adaptive learning and AI can make learning more personalized, effective and fun, adjusting automatically to children’s abilities, preferences and learning levels. Already existing programs, such as Mindspark, can support improvements in learning outcomes in various subjects by adapting to learners’ progress and providing feedback. Linking back to the global learning crisis, digital learning holds tremendous untapped potential for developing foundational literacy and numeracy skills. But none of this will be fully leveraged if the ‘digital chasm’ continues to widen.

Technology in education is no longer a nice to have – it is a necessity that is here to stay. According to UNICEF estimates, universalizing digital learning by 2030 will require $1.4 trillion. While it is ambitious to reach all children with digital learning opportunities by 2030, it is achievable if public and private partners come together to build on the promising investments, partnerships and strides made in recent years to prioritize underserved areas and populations. We must seize and accelerate this once-in-a-generation opportunity to drive real and meaningful change to reimagine education.

|

|

|

|

|

2022 EdTechX All Stars Awards Launch

EdTechX are pleased to announce the launch of the 2022 EdTechX All Stars Awards, honouring the top startups and scale-ups shaping the global EdTech industry across geography, segmentation and industry trends. Evaluated on company size, growth, innovation, and efficacy of ESG and impact initiatives, applicants will be considered across three categories - Startup, Scale-Up and, new for 2022, the ESG & Impact category.

Following two years of disruption to the live EdTechX All Stars Awards ceremony, EdTechX are thrilled to see the return this year of our celebratory Awards Ceremony due to be held at the EdTechX Summit on 23 June 2022 at Tobacco Dock in London. We are also delighted to welcome our 2022 Awards sponsors who will be evaluating the entrants of their respective Awards categories, as well as providing prizes and benefits for this year’s winners.

Every year, the EdTechX All Stars Awards aim to showcase the most innovative, fastest growing and impactful companies transforming the education and training landscape. The EdTechX Startup Award, sponsored by Cooley, recognises EdTech startups for significant innovation and growth, or more advanced companies have the opportunity to be showcased for demonstrable revenue growth momentum with the EdTechX Scale-Up Award, sponsored by Google Cloud. The new ESG & Impact Award, supported by EdTechX Holdings and IBIS Capital, highlights education and training companies that can demonstrate meaningful ESG (Environmental, Social, and Governance) policies and impact strategies in education and learning. For this award, entries will be evaluated on 7 principal criteria based on an ESG & Impact evaluation methodology developed by EdTechX Holdings and IBIS Capital.

We look forward to celebrating the 2022 winners at the EdTechX Awards Ceremony at our summit in June where winners will be presented with prize packages and benefits from our partners and sponsors. Find out more about the 2022 EdTechX All Stars Awards here >>

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| M&A Activity > |

|

|

|

| Significant Fundraising Activity > |

|

|

|

|

|

COVID-19 and Education Valuations

Key Points

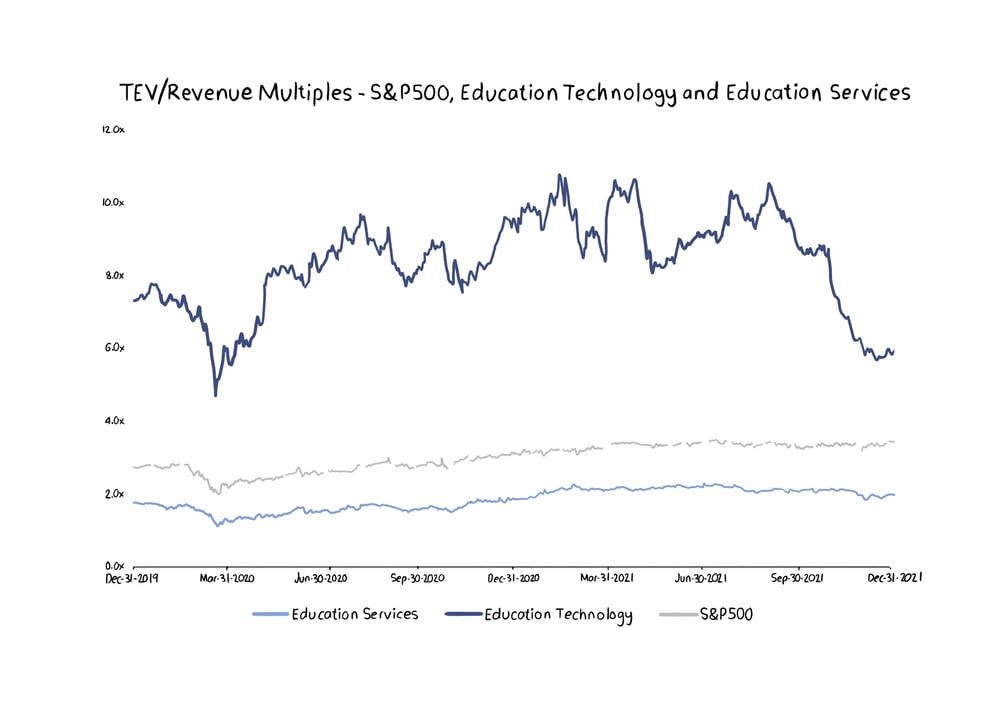

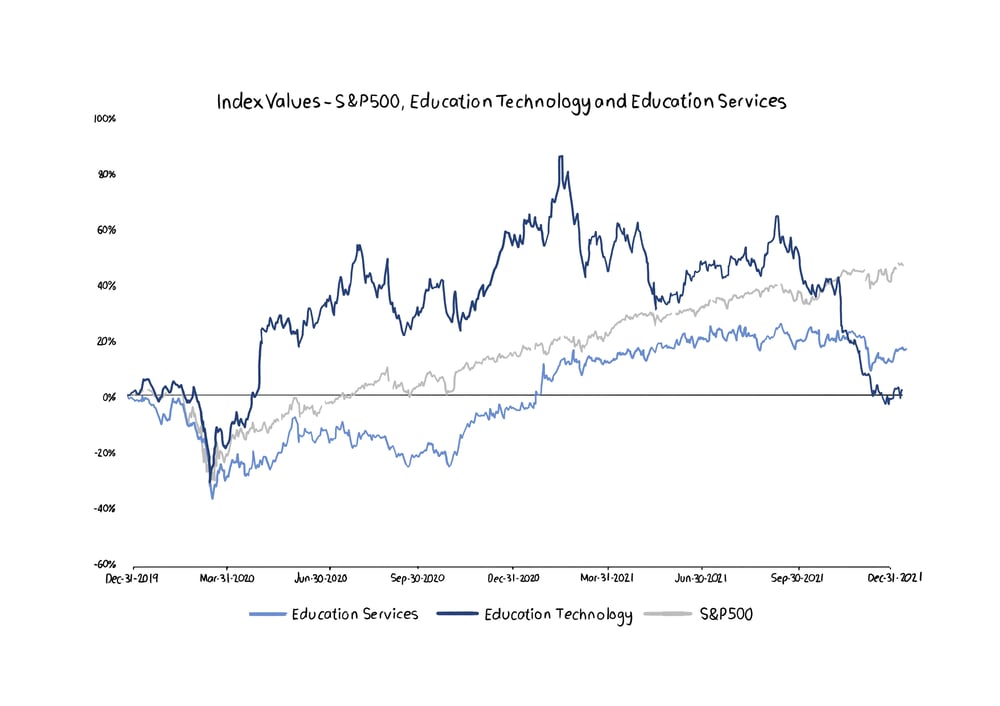

As an industry that has historically been slow to digitise, education was upended by the pandemic. Forced online, the pandemic had a transformative impact on students and educators worldwide. The accelerated digital transformation in education has not gone unnoticed by the markets, and we have seen unprecedented amounts of capital flow to education companies at higher valuations than ever before. However, despite the tailwinds of the last two years, recent months have seen some downward pressure placed on valuations as we slowly emerge from the pandemic.

As prior to the pandemic, Education Services companies, whose products include textbooks, certifications and assessments continue to trade at lower revenue multiples relative to the S&P500 and have broadly traded in line with the index throughout the last two calendar years. The goods and services offered by these companies were already well-adopted in a pre-Covid world, meaning the shift to online learning didn’t have the same benefits for these companies when compared to their Education Technology counterparts. The solutions offered by Education Technology companies, on the other hand, were key in enabling learning to continue outside the classroom. This unprecedented surge in demand saw valuations for Education Technology companies soar. At their peak in February 2021, revenue multiples of Education Technology companies reached 10.8x, more than double their March 2020 trough of 4.7x.

Education Technology valuations have, however, been more volatile when compared to Education Services companies and the S&P500, and despite strong investor appetite for Education Technology stocks for the bulk of the last two years, valuations began to wane in the second half of 2021. As with many stay-at-home stocks, including the likes of Zoom and Peloton, investor attention turned to companies that will benefit from the reopening of economies and the return to in-person activities. Valuations consequently dropped from their February 2021 peak and ended 2021 at 5.9x, which is interestingly below the pre-pandemic December 2019 level of 7.3x. Chegg, for example, saw their valuation dented in the second half of last year. In November 2021, after reporting weaker than expected Q3-21 earnings in the face of increased employment opportunities and compensation levels, returns to in-person lectures and lower than expected enrolments, Chegg’s share price dropped close to 50% and has not recovered since.

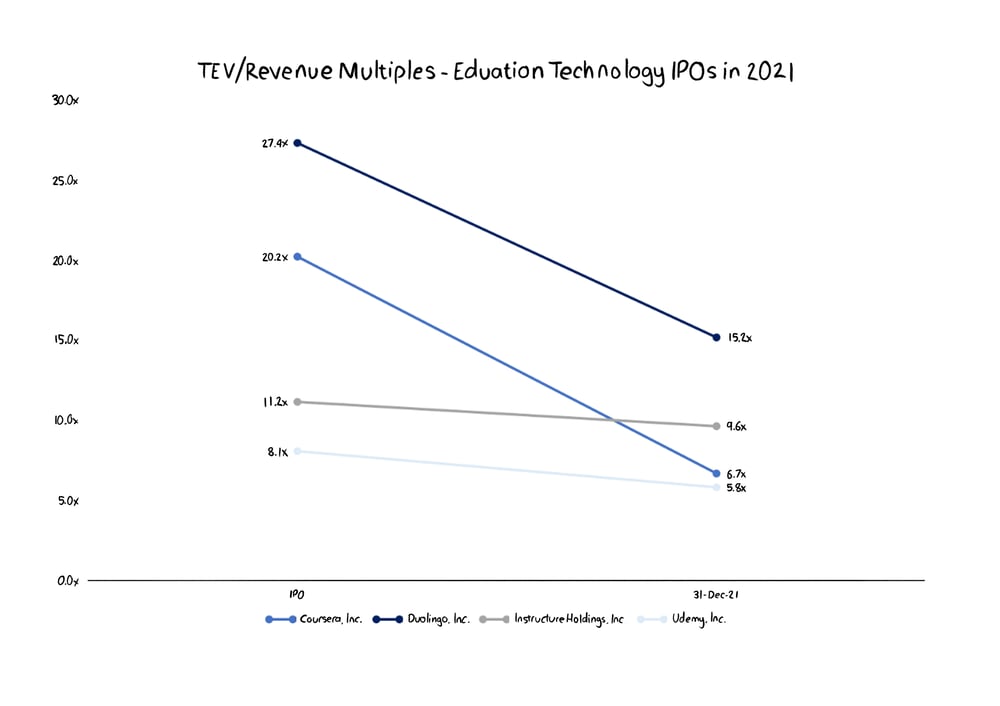

Several Education Technology companies took advantage of the investor enthusiasm for education stocks in 2021 and raised hundreds of millions of dollars on their initial public offerings. Coursera, Duolingo, Instructure and Udemy collectively raised in excess of $1.7bn in public markets in 2021 and a look at their post-listing performance is an insightful case study in picking the right time to list.

On average, these four companies were valued at 16.7x revenue on their respective listing dates although by the end of 2021, this had fallen to 9.3x – a drop of more than 40%. While these companies have seen their valuations negatively impacted by the world’s reopening and the return to classrooms and lecture halls, the drop seen in valuations is perhaps evidence of clever thinking by these companies who clearly picked opportune moments to raise significant amounts of capital at healthy valuations.

Cleary a beneficiary of the pandemic, it is no surprise that Education Technology valuations boomed over the last two years. The reopening of our world has created some significant headwinds for these valuations however, and with many education companies due to report 2021 earnings in the coming weeks, further movement in these valuations is certainly expected.

* Education Technology Constituents: Chegg, Duolingo, Coursera, PowerSchool, Udemy, Docebo, 2U, Arco Platform, Keypath, 3P Learning, Tribal, LTG, Instructure

* Education Services Constituents: Pearson, IDP, Wiley, Houghton Mifflin Harcourt, Scholastic, Strategic Education, Stride

|

|

|

|

|

|

|

|

|

|