|

|

|

|

|

|

In this month's X Report, we have a preview of the Global EdTechX Report and highlights of what is planned for the online EdTechX Summit. Each month, we will share a snapshot of key trends, showcase the stars of today and tomorrow, provide some food for thought as well as mergers, acquisitions and fundraising.

|

|

|

|

|

The EdTechX Global Report

Addressing the Likely Impact of COVID-19 on use of Technology in Education and Training

The impact of the COVID-19 outbreak and resulting containment measures on Education and Training has been enormous. 1.7bn learners, or c.90%, are estimated to be currently learning from home, while employers are rapidly seeking remote work solutions as a global recession looms. The IMF is projecting a 4.2% global economic contraction, considerably worse than what was felt following the Global Financial Crisis in 2008.

Amidst this somewhat gloomy outlook, EdTech is offering a lifeline for learners across institutions and at work to continue education and training. Adoption of EdTech has drastically increased as many companies offer their platforms for free during the pandemic, resulting in a global online learning experiment like never seen before. Growth in Online Education is a long-term trend, with the COVID-19 pandemic acting as a catalyst. The paid user base is expanding, and customer acquisition costs are falling.

Due to COVID-19, a c400bn shortfall in education and training globally is expected in 2025. Education’s large public spending component will be partially protected from the global downturn except for early years, which is largely privately paid and expected to be heavily impacted by COVID-19. Therefore, education spending is expected to grow faster than the world economy reaching 6.6% of global GDP in 2025. Higher education and training is likely to see slight boosts towards the back-end of the recession as workers retrain in order to participate in economic recovery. Long term growth is still expected in K-12 and early years however, at a lower rate.

Currently the size of the global EdTech Market is estimated at $187bn. Taking the COVID-19 impact into account, the market is expected to grow between 14.5% - 16.4% per annum to a total value of $370-$410bn in 2025. The current pandemic is driving an increased uptake of technology in order to replace, supplement and enhance learning in the context of social distancing. Over the course of 2020, EdTech firms will be focused on gaining market share and therefore often giving their products away for free. Therefore, incremental revenue will likely only begin in 2021, with many technologies trialled in 2020 being paid for and gaining wider usage. By 2025, it is expected that this step change in usage will result in around $40-$80bn additional annual revenue in EdTech. EdTech is therefore expected to grow its share of Education and Training Spend from 3.1% in 2019 to 5-6% in 2025.

Post COVID-19, the road to recovery may have multiple periods of social restriction creating a staggered return, varying in time and geographically. The immediate response in education has been to move online largely with video with the second stage looking to see greater use of digital tools to enhance engagement and efficacy. The science of learning is moving EdTech beyond simple digitalisation towards digital transformation. The next focus is on reconfiguration and optimisation of delivery powered by AI that is able to learn from experience and improve the efficacy of human and machine learning. Institutional demand to address digital resources and upskilling will be restricted due to limited government funding in a recessionary environment. As such, consumer behaviour will likely be a key driver impacting supply-side business models, demand for reskilling, supplemental teaching and training with an increased universe of users. The next wave will see the proving of the most effective pedagogical solutions and the accelerated use of tools that harness AI and deep learning.

The EdTechX Global Research Report is in collaboration with IBIS Capital and Cairneagle Associates. The full report will explore the growth in EdTech adoption during lockdown and long-term prospects. It will take a holistic view of the market drivers including COVID-19 segmented across education phases, product types, geographies and more to highlight where the opportunities and challenges lie.

|

|

|

|

|

|

EdTechX Moves Online for the Largest Summit on Education & Training Amidst COVID-19

As COVID-19 has swept across the world, governments have rightly moved to impose social distancing measures in a bid to slow the spread of the virus and protect vital health infrastructures. This has catalysed the largest online learning and remote working experiment in history, with many questioning what the ‘New Normal’ will entail.

Now more than ever, EdTechX sees it to be essential for our sector to come together to discuss the immediate effects, discuss what the long term implications may be and share insights and lessons learned. As many prepare for a Second Wave of the pandemic, now is the time to learn what has been successful and source new initiatives.

The online EdTechX Summit will curate a diverse selection of international thought leaders to share their perspectives on how leading institutions have rapidly transitioned online, how companies have pivoted to maximise work-from-home models, the global leadership lessons learned and what EdTech trends will emerge in a post-COVID-19 world.

As the world adjusts to a work from home lifestyle, it's now more important than ever to find ways to grow your network, create business opportunities, develop partnerships and start future collaborations. The online EdTechX Summit will offer a bespoke, AI powered, networking platform to help you make new connections, have 1-to-1 video meetings and connect with colleagues from around the world - all without leaving your home. In addition, all the sessions will be shared through an on demand content library, allowing you to select the content you want to watch - whenever, wherever and on any device.

Over 100 speakers and 700+ attendees from more than 45 countries will be joining the online summit next week for the most connected, essential EdTech event of 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| M&A Activity > |

|

|

|

| Significant Fundraising Activity > |

|

|

|

|

|

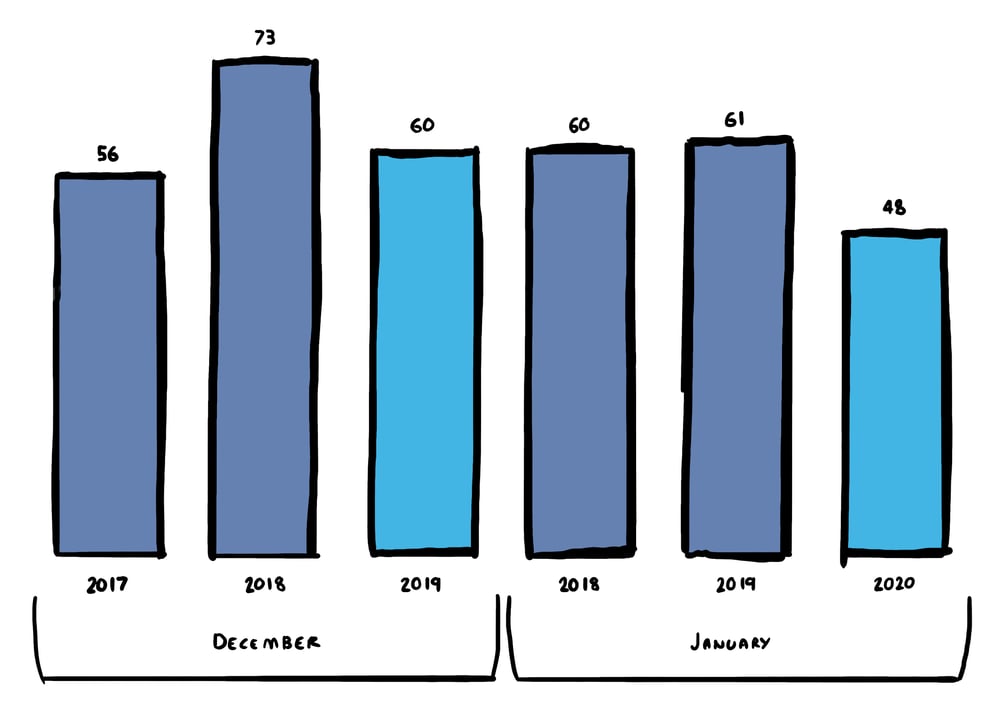

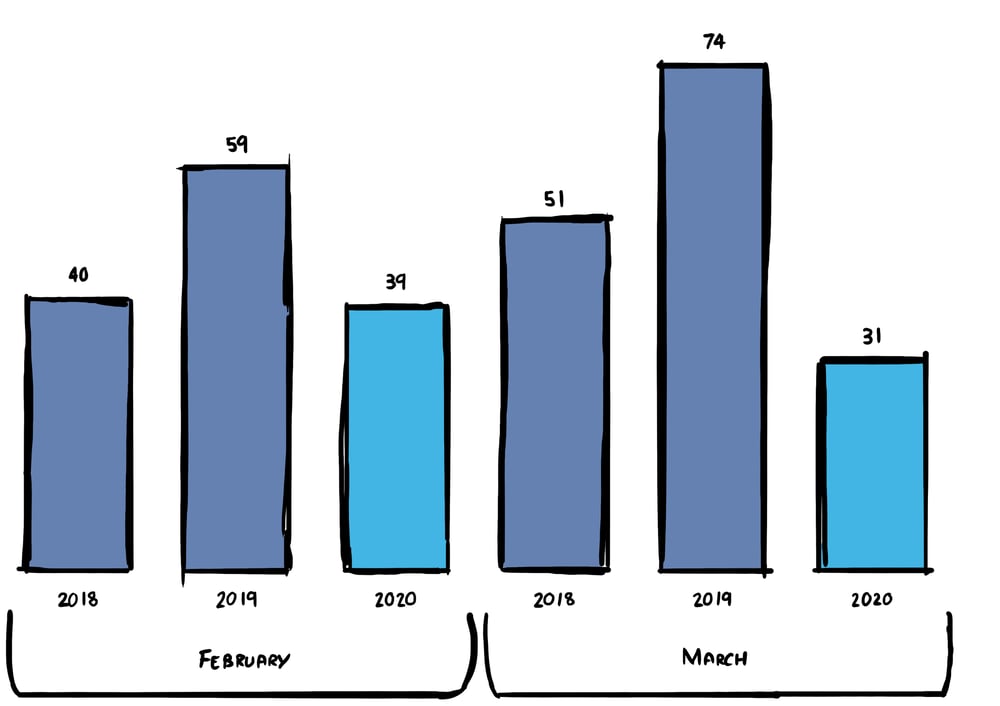

Education & Training M&A Volume Year-on-Year

COVID-19 has wreaked havoc on the markets in the first quarter of 2020, with global equity indices losing 30-35% of their value in a matter of weeks. The effect of COVID-19 has also been felt in the M&A market, with many acquisitions being put on hold and almost all IPOs planned for 2020 being shelved. The education and training sector has followed this trend, and average monthly deal volumes have dropped from 50 in Q1 2018 to only 39 in Q1 2020.

The effect was first felt in Asia-based acquisitions as companies struggled to assess the impact of COVID-19 on their operations. EF Education First, a language training provider, put the sale of its Chinese unit on hold (expected deal size of $1.5-2 billion) and Navis Capital suspended plans to sell the Chinese operations of its education resources business. Fundraising in the region remained strong for the most part, and in late March, the Beijing-based online education company Yuanfudao closed a $1 billion Series G round, marking the largest-ever fundraising deal in China’s online education sector.

Other regions experienced a similar decrease in M&A activity. The sale of UK-based Oxford International Education Group was suspended due to market uncertainty and the sale of US-based Laureate Education’s Australian and New Zealand division is also likely to be delayed. The developed markets experienced a bigger impact on fundraising activity over the period, and the US was the hardest hit with a decrease of over 30% on Q1 of previous years.

Activity is however expected to revert to previous levels in the medium term as the pandemic accelerates consolidation. New sales are being launched where there is a clear strategic rationale, but it is likely to be more difficult for buyers to secure debt financing for a purchase. This provides an opportunity for private equity; dry powder is at a record high ($2.5 trillion at the end of 20191) and offers buying power for these investors who will be looking for quality assets in resilient sectors. EdTech is likely to be an attractive investment option if the sector can prove stability going forward.

|

|

|

|

|

|

|

|

|

|