|

|

|

|

|

|

In this month's X Report, we look at product differentiation in EdTech; we share tips and tricks on the fundraising process, and explore Venture Capital Investment in EdTech. Each month we share a snapshot of key trends, showcase the stars of today and tomorrow, offer our insight on mergers, acquisitions and fundraising, as well as providing some further food for thought.

|

|

|

|

|

The Power of Standing Out in a Sea of Sameness

Jonathan Viner, Founder of 10Digits

When shopping for a birthday gift recently, I noticed a new board game called Herd Mentality. The winner is the player whose answers blend in best with everyone else’s and players are advised: “whatever you do, don't stand out!”

Unfortunately, I get the increasing impression that many EdTech businesses are following this advice by trying to look and sound exactly the same. I’m not the only one to notice this trend - as Matthew Tower wrote in a recent newsletter, there are at least 17 companies currently describing themselves as “the Netflix for education”!

I can understand the thinking behind this decision - maybe it makes it easier for people to understand what your business does and perhaps it’s a simple analogy for users to get their head around? But I’d argue that it’s actually storing up future problems when your business grows or pivots and, for better or worse, your brand is always tied to the larger player, its market performance and public behaviour. Most importantly, my fear is that these companies sail in a sea of sameness - they’re ambiguous, generic and undifferentiated.

That’s a major challenge when, as EdSurge identifies, there’s an oversaturation problem in EdTech. It’s an even bigger problem when most EdTech buyers are being bombarded with hundreds of marketing messages every day. How can companies hope to grab their prospects’ attention if they look and sound like everyone else?

Creating a unique position for your brand / product and intentionally leaning into that difference is, I believe, critical to rise above the noise. Positioning guru, April Dunford, is clear on the importance: “Customers need to be able to easily understand what your product is, why it’s special and why it matters to them.” And there’s plenty of other evidence that reinforces the benefit of a clear positioning.

Importantly for startups, research conducted this year by Columbia and Tsinghua Universities found that highly differentiated businesses raised 117% more early-stage funding and were more likely to succeed in the long-term, although they did take more time to take off. Other evidence suggests that being unique and different is both more profitable and a powerful driver of brand value. And there are numerous examples from luxury fashion that highly differentiated businesses with a unique position are better able to generate a price premium from consumers.

So, if your product is sinking in this sea of sameness, what can you do to help it survive and thrive? The first step I’d recommend is to be clear about the elements of your proposition that customers really value - this helps you identify the areas where you can create genuine separation. This doesn’t have to be just about your product - it could relate to your customer support, a unique onboarding process, a powerful partner ecosystem or even a vibrant user community.

These differences and strengths can then form the core of your position moving forwards. Build on them to create distinctive brand assets and unique customer communications. Run these consistently across all media, taking the time to fully brief / update all staff. Be brave, be bold and seek the clear blue water between you and your competitors.

Take inspiration from Judy Garland, who once said: “Always be a first-rate version of yourself, instead of a second-rate version of somebody else.” Although I’ll admit, this isn’t a strategy for winning many games of Herd Mentality!

Jonathan Viner is the founder of 10Digits, a consultancy that works with EdTech entrepreneurs to build great brands and high-growth businesses. He publishes Nordic EdTech News and is a regular commentator, speaker and writer on EdTech trends.

|

|

|

|

|

EdTechX Panel Spotlight - Fundraising

Why Some Succeed and others Fail

Fundraising is a hurdle all EdTech companies have to face. A panel of investors and experts* joined us at the EdTechX Summit in June to share tips and tricks on the fundraising process. Here are the key takeaways.

Start the process early and choose your investors wisely

It can take months or even years to find the right investors for your business, so starting the process early is highly recommended. Startups should first determine what their targets are and what types of investors are right for the company. “Think about what sort of role you want the investor to play – do you just want the funds or do you want them to be an active advisor?”, said Cooley Attorney, Matthew Johnson.

Build links with sector specific investors

Helen Gironi, Director of Ufi Ventures recommended building links with business angels that know your sector. “They will provide a sense of comfort to institutions that come in later”, she explained. Sector specific funds can also make decisions more quickly, and will have other startups in their portfolio that you can collaborate with and learn from. Lumina Foundation President and CEO, Jamie Merisotis recommended attending as many conferences as possible to make these connections.

Key metrics investors look for: social impact, benchmarks and ARR

For Helen Gironi, social impact is as important as the commercial impact. “If a company is generating profit, it will scale more quickly and lead to greater social impact”, she said. On financial metrics, Matthew Johnson advised companies to establish benchmarks for seed rounds - where will the funding get the business to in terms of scale, profitability and year-on-year growth - and what will the time frame be? Other key metrics that Helen Gironi looks for include growth in annual recurring revenue and user engagement. Having a business model that demonstrates a deep understanding of the market is also paramount according to Julia Steger, Chief Operating Officer at EDUvation.

Take on board the feedback and work on it

How should entrepreneurs deal with rejection? First of all, accept a ‘no’ for a ‘no’, remarked Jamie Merisotis. However, a ‘no, not now’ is very different and should be taken seriously. “Study the feedback and decide if you still want to work with that investor. Adapt your business plan based on the feedback if necessary”, he advised. Matthew Johnson also pointed out that, in the current climate, things are moving more slowly so you need to be patient. “Use that time to build on your relationships with your clients”, said Julia Steger. “This will strengthen your case with future investment conversations”, she added. But take heed. A ‘yes’ that needed convincing is not a good outcome.

*Thank you to our panellists Matthew Johnson, Attorney at Cooley, Helen Gironi, Director of Ufi Ventures, Jamie Merisotis, President & CEO at Lumina Foundation, Julia Steger, COO at EDUvation and Svenia Busson, Co-founder & Chairwoman of the board at the European Edtech Alliance (Panel moderator)

Watch the full panel session recording here*

*To access the recorded sessions, registered ticket holders can log in using their registered email address. Non-ticket holders can purchase the 2022 OD Content Pass to access all the session recordings from the 2022 EdTechX Summit.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| M&A Activity > |

|

|

|

| Significant Fundraising Activity > |

|

|

|

|

|

Industry Analysis – Venture Capital Investment in EdTech

Key Points

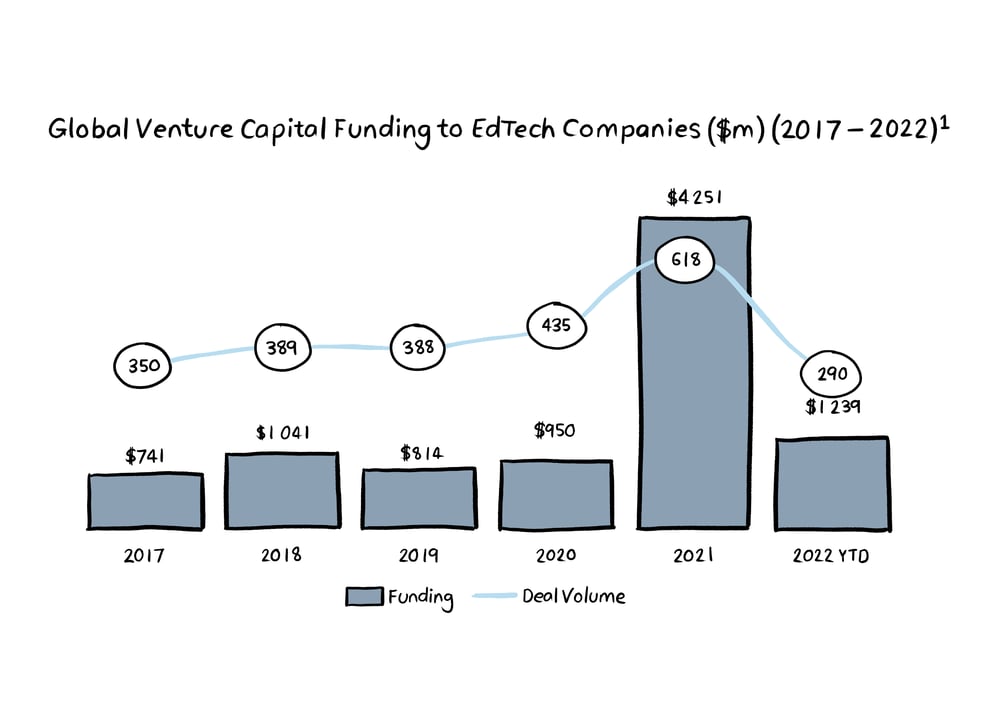

VC funding in 2022 has been robust, having achieved higher funding values than the preceding pre-pandemic years (2017 – 2020), despite having declined both in terms of deal volume and value since the exuberant highs of 2021. While deal volume was the lowest in the last 5 years at 290 deals YTD, average deal size in 2022 was higher than 2017 – 2020, contributing to the healthy fund flows. Notable themes within the EdTech industry across VC funded firms included artificial intelligence, corporate training, analytics & big data, E-commerce and career planning.

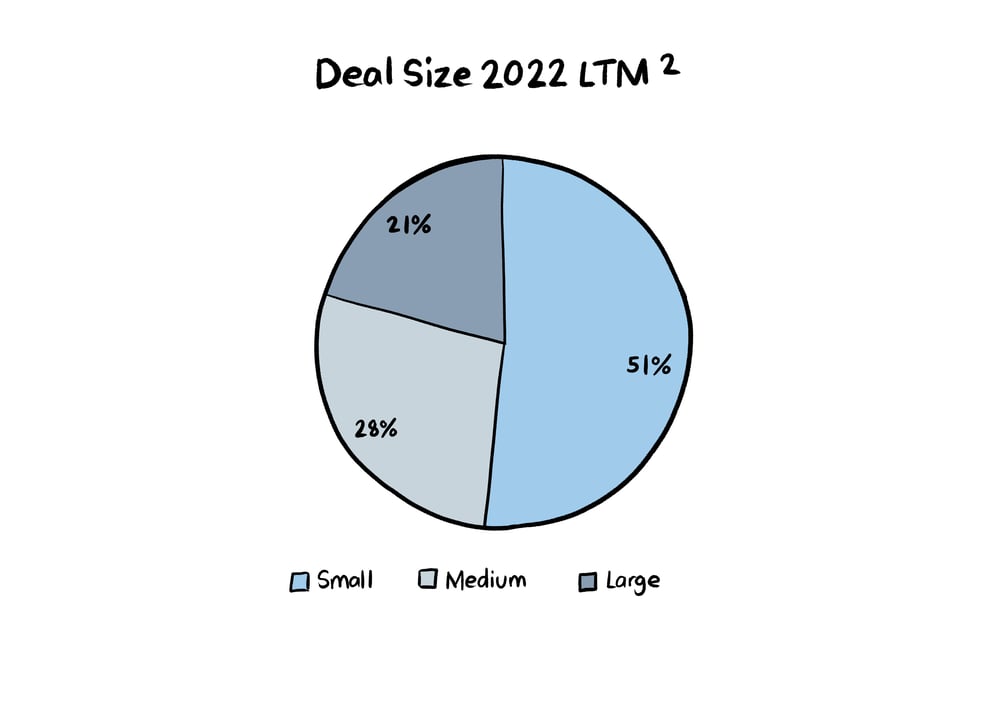

Unsurprisingly, small deals (defined as transactions with size less than $1m) accounted for the vast majority of deal value in 2022 LTM and comprised 51% of deal volume. Notable series A deals in 2021 and 2022 include Articulate, the US-based workplace training platform which raised $1.5bn, Fenbi, the Chinese examination services company which raised $390m and Physics Wallah, the Indian tutoring site that raised $100m this year. Large VC funders active in the space over this time include General Atlantic, Insight Partners, Softbank Ventures, Owl Ventures and Tiger Global Management.

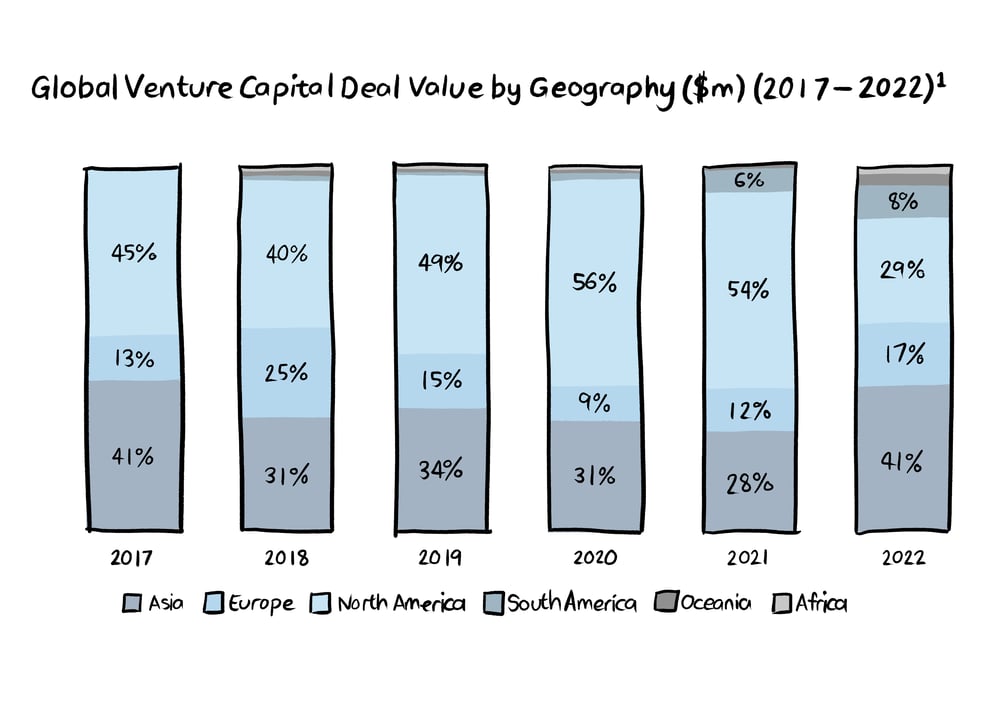

From a geographic perspective, deal value by region has shifted over the last 3 years with the North American dominance in 2020 and 2021 being overturned by Asia in 2022, which increased to 41% of total deal value in 2022. Europe and South America also saw significant increases compared to 2021, increasing to 17% and 8% of total deal value respectively. Looking deeper into this breakdown, India has raised more VC capital than China in both 2021 and 2022 YTD, becoming the country receiving the second most VC funding in the world behind the US. Other notable countries receiving VC funding were the United Kingdom, Singapore and Australia having raised 8%, 5% and 4% of global funding in 2022 respectively.

Notes:

1. Data as per Crunchbase defines Venture capital: Pre-Seed, Seed, Series A, Series B.

2. Small deals are considered to be <$1m; Medium deals are considered to be ≥ $1m<$5m; Large deals are considered to be >$5m

|

|

|

|

|

|

|

|

|

|